Photo Credit: iStock.com/Artist's artisteer

Let’s harken back to the Occupy Wall Street protests. Mostly it was the young, unemployed and college-going protestors who made up for the bulk of the movement. A burgeoning amount of student loans have fueled rage over how the bankers got off relatively scot-free and the students didn’t. Student debt was at an all-time high yet those mucking around with the nation’s economy were bailed out. President Obama was under intense glare over the response post-2008 financial crisis. Many protestors in Occupy Wall Street wanted to enjoy similar relief when it came to pursuing their higher education.

One justification given for the increased anger on part of college students was that the Presidency ended subsidies for private banks that handed out federally guaranteed student loans. This put the students at the private banks’ mercy as opposed to the government, making high interest rates the norm for struggling students. Even those private loans for education are hard to get, requiring a lot of hoops to jump for students in order to qualify.

To quote a general example, in the mid-1980s, $2,500 was the federal limit to student loans yearly. This meant an average student graduated with $10,000 in debt and paid it off by working 3 jobs.

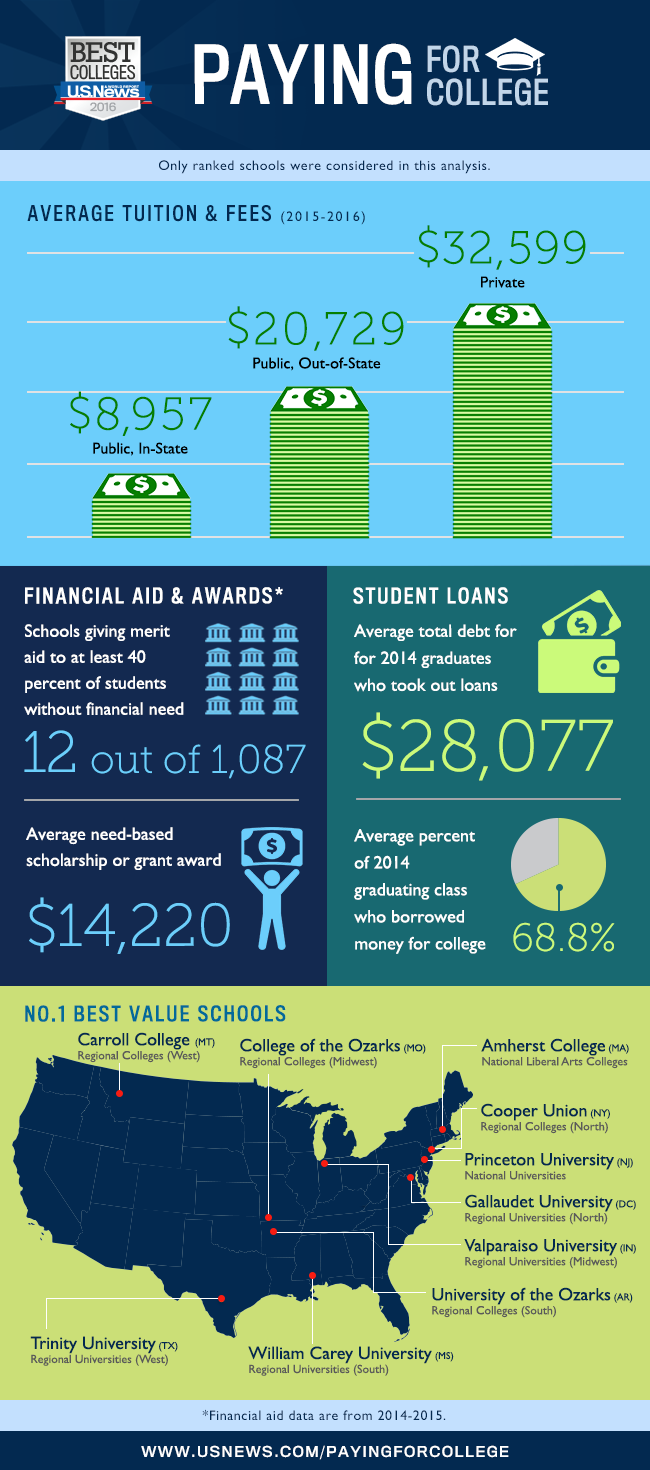

Today the whole student debt sits at $1 trillion. That’s even more than credit card debt accumulated by Americans! This is because now the limit on federal loan is $31,000 for 4 years. The average college graduate has $25,500 debt in student loans. Unemployment is high and median incomes are low.

– Source: US News

All this has made the federal financial aid 4x times more in the last 30 years. Two thirds of USA’s massive budget shortfall is constituted by debt load carried by grads.

The government needs to step in and change policies towards loans and educational aid. The first thing they need to ensure is that loans are easy to pay back with lower interest rates. Secondly, education should well be within reach of every American irrespective of their financial situation. In both these scenarios government is effective if it implements policies that are student-friendly.

Top academic surveys have revealed that lowering the barrier to education by offering incentives to students is the way to go. However, in view of governmental apathy, the private sector steps in and makes education and its pursuit more prohibitive. High college costs need to be focused on. Training the next generation of scientists and professionals is something that a superpower needs to take care of continuously unless it needs to be knocked off its pedestal.

Kelvin Stiles is a tech enthusiast and works as a marketing consultant at SurveyCrest – FREE online survey software and publishing tools for academic and business use. He is also an avid blogger and a comic book fanatic.